|

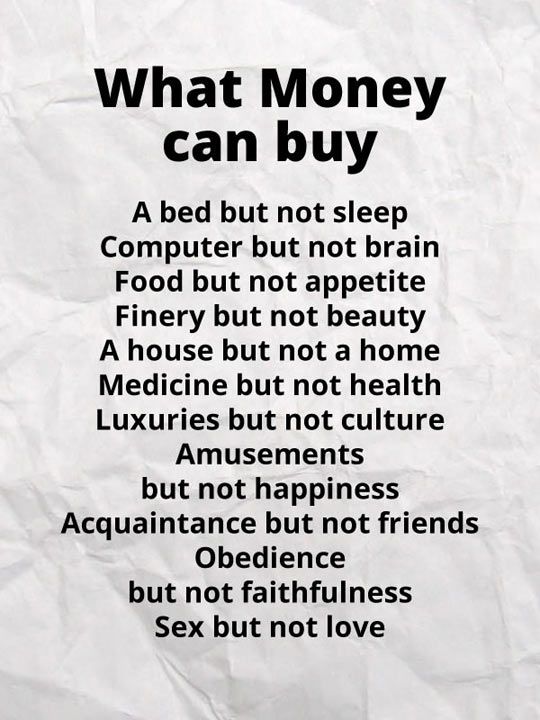

This is a topic that sparks lot of different opinions. There's always a tug-of-war between tangible and intangible contributions. Much of the support functions come under serious scrutiny when the parameter for judging their overall contribution is the much hyped tangible financial contributions alone. It totally negates the worth of those functions when the yardstick is money creation. Well it depends on the way we look at wealth. First & foremost, wealth is a much broader term and means a plentiful supply/abundance of a particular desirable thing. Money alone is not wealth. If money would have been the criteria then I am sure all the rich people on earth would have been so fulfilled, happy and satisfied in life. More the focus on money, more is the inner vacuum, more the scarcity of the desirable things in life. At the end, why are you even creating money?! Because you want to create abundance of desirable things in life which eventually leads you to fulfillment, joy & happiness. Isn't it? Let's dissect this and see as to who actually is wealthier? I am not an advocate against money creation, but more than money I belief in creation of abundance, fulfillment & happiness. I was having a discussion with one of my female friends who left her successful corporate career to pursue her passion & have a fulfilling life, having it all. While in the corporate, she had a great bank balance and was holding a high position. But, it was exactly at that time that she was going through a difficult patch in her relationship nor she could give her time to her kids. She was full of guilt and was just moving ahead with life going nowhere. To the world she was worthy, seen as someone contributing. But, when we stand in front of the mirror and try & see through us, we get the answers which may not necessarily be the same as the people around us think so. Finally something dawned on her and she decided to leave her job. Her health was also one of the contributing factors to that decision. So here she was at this stage of her life sitting with a decent bank balance, with an almost broken relationship with her spouse, with two unhappy kids on the verge of becoming unruly and her ill-health. Slowly with the passage of time, she picked up her passion and converted it into her profession; her relationship with her spouse started improving, they became friends if not anything else; kids became responsible and started mirroring her calm presence; she has more nurturing time to rejuvenate; her illness got cured and she started to have a healthy, balanced and fulfilled life. What about her bank balance?! She obviously doesn't earn that much money because it is her choice, but whatever she earns, it gives her comfort, joy & fulfillment. Someone tried to judged her recently based on what her financial contributions were to her family, to this she gave an apt reply: "I am wealthier than before. I have those things which money cannot buy, nor take away from me. I now know how to manage resources much better than before. I now know what is important and what isn't. I now know that I am making a difference to my kid's life which money never brought earlier. Now, costly toys have been replaced by family time together that helps creating a deeper bond with the children; diamond sets have been replaced by personal dates with my husband, we are friends; my external sense of worth has been replaced by my love for authentic self; I now have a successful fulfilling career, loving relationships, happy responsible kids, nurturing me-time & I am using my skills to contribute to a bigger cause than self, I donate to an NGO close to my heart. So, you decide who is wealthier? My earlier self or this one? " Next time you decide to judge/demean anyone based on the financial contributions that they are making, do remind yourself of this real episode and try to see the person beyond money. Likewise, a support function's contribution cannot just be equated with money. The contributions are way beyond. Only if you are willing to see, you will see it. Love, Priyanka

2 Comments

11/25/2022 11:47:31 pm

Very nice… I really like your blog as well as website. Very useful information and worth reading. Thanks

Reply

11/11/2023 06:03:21 pm

Hii, thanks for sharing the info, can i do blog commenting in all these sites or need to do only on those places whioch is related with the industry.

Reply

Leave a Reply. |

AuthorLife & Organizational Development Coach Archives

February 2023

|